GIỚI THIỆU CHUNG

Khu Đô thị công nghiệp Dung Quất có vốn đầu tư hơn 2.000 tỷ đồng trong giai đoạn 1 do Công ty CP Hoàng Thịnh Đạt làm Chủ đầu tư (giấy phép đầu tư số 7020466318), hứa hẹn là cú hích cho hạ tầng Khu kinh tế Dung Quất và các đô thị phía Bắc Quảng Ngãi, vươn tầm phủ sóng lan rộng sang cả Khu kinh tế Chu Lai ở phía Nam tỉnh Quảng Nam, cũng đang quy hoạch thành đô thị vùng. (Quyết định báo cáo đánh giá tác động môi trường)

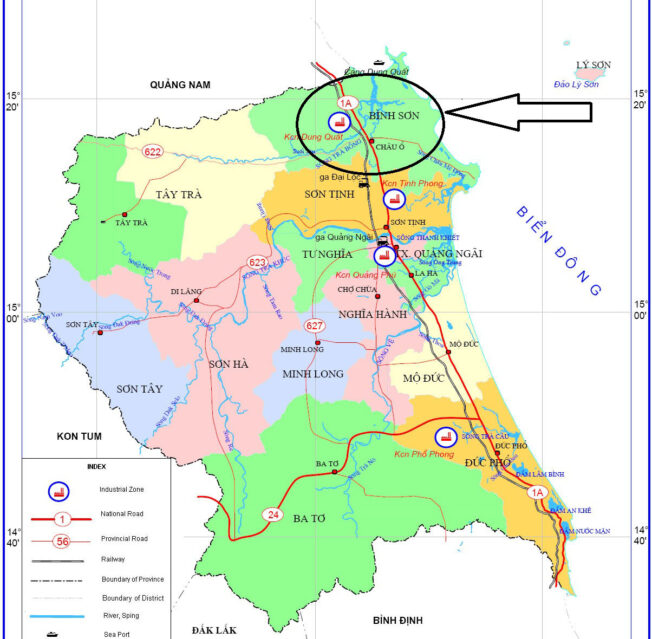

Xã Bình Chánh và Xã Bình Thạnh, Huyện Bình Sơn, tỉnh Quảng Ngãi.

Toàn bộ Dự án Khu đô thị công nghiệp Dung Quất được định hướng phát triển với tổng diện tích là 1.303 ha, gồm 2 giai đoạn: Giai đoạn I 319 ha, Giai đoạn II: 984 ha. Vị trí cụ thể đã được Ban quản lý Khu kinh tế Dung Quất thống nhất theo Văn bản số 895/BQL-QLQH&XD ngày 7 tháng 7 năm 2016.

Công ty CP Hoàng Thịnh Đạt đề xuất trước mắt sẽ tập trung phát triển Giai đoạn I với quy mô 319 ha đất để phát triển khu công nghiệp và dịch vụ. Các giai đoạn phát triển tiếp theo sẽ được Công ty nghiên cứu và đề xuất cụ thể trước khi tiến hành triển khai.

QUY MÔ

| BẢNG TỔNG HỢP QUY HOẠCH SỬ DỤNG ĐẤT | |||||||

| TT | Loại đất | Giai đoạn 1 | Định hướng giai đoạn 2 | Tổng | |||

| Diện tích (ha) | Tỷ lệ (%) | Diện tích (ha) | Tỷ lệ (%) | Diện tích (ha) | Tỷ lệ (%) | ||

| 1 | Đất xây dựng nhà máy, xí nghiệp | 267,75 | 83,89 | 93,63 | 52,95 | 361,38 | 72,86 |

| 2 | Đất công cộng | 14,62 | 4,58 | 8,78 | 4,97 | 23,40 | 4,72 |

| 3 | Đất công viên, cây xanh | 9,65 | 3,03 | 55,62 | 18,54 | 65,27 | 10,54 |

| 4 | Đất đầu mối hạ tầng kỹ thuật | 7,14 | 2,24 | 49,39 | 27,93 | 56,53 | 11,40 |

| 5 | Đất nhà ở công nhân | 0 | 0 | 3,20 | 1,81 | 3,20 | 0,65 |

| 6 | Đất giao thông | 20,01 | 6,27 | 21,82 | 12,34 | 41,83 | 8,43 |

| TỔNG | 319,18 | 100,00 | 176,82 | 100,00 | 496 | 100,00 | |

TỔNG VỐN ĐẦU TƯ

Tổng vốn đầu tư của Dự án giai đoạn I là: 2.025.000.000.000 đồng (Hai nghìn không trăm hai mươi lăm tỷ) đồng.

THỜI GIAN THỰC HIỆN DỰ ÁN

Thời hạn hoạt động của Dự án là 50 năm kể từ ngày được ký Quyết định chủ trương đầu tư.

Dự án được chia làm 2 giai đoạn phát triển chính bắt đầu từ quý III/2016 với tiến độ cụ thể như sau:

Giai đoạn I:

- Giai đoạn IA: Phát triển khoảng 166 ha đất công nghiệp, trạm xử lý nước thải với công suất 25,000 m3/ngày-đêm, trạm cung cấp nước sạch 31,000 m3/ngày-đêm và triển khai các công trình hạ tầng trong khu công nghiệp.

- Giai đoạn IB: Phát triển khoảng 153 ha đất công nghiệp. Đầu tư xây dựng Giai đoạn 2 của Trạm xử lý nước thải với công suất 25.000 m3/ngày-đêm trạm cung cấp nước sạch 31,000 m3/ngày-đêm và triển khai các công trình hạ tầng trong khu công nghiệp.

Giai đoạn II: Xây dựng và phát triển hạ tầng trên diện tích còn lại của dự án khoảng 984 ha.

Việc chia dự án ra thành các giai đoạn phát triển như trên chỉ có khái niệm về mặt thời gian. Thực tế, khi Giai đoạn IA đã phát triển và lấp đầy được khoảng 60% diện tích, Chủ đầu tư sẽ triển khai đầu tư xây dựng ngay Giai đoạn IB của dự án.

CÁC NGÀNH NGHỀ THU HÚT ĐẦU TƯ

Phần lớn đất sử dụng trong Khu sản xuất công nghiệp sẽ được sử dụng để xây dựng các hệ thống nhà xưởng và nhà máy. Các lô đất sẽ được phân chia với các quy mô lớn và vừa, phù hợp với nhu cầu của các doanh nghiệp. Khu Đô thị công nghiệp Dung Quất sẽ được tập trung thu hút các doanh nghiệp thuộc các ngành sau:

- Sản xuất, lắp ráp thiết bị điện, điện tử, viễn thông;

- Sản xuất lắp ráp ô tô và linh kiện máy bay;

- Sản xuất thuốc, hóa dược và dược liệu;

- Sản xuất hóa chất và các sản phẩm hóa chất;

- Sản xuất chế biến thực phẩm, đồ uống;

- Sản xuất da và các sản phẩm có liên quan;

- Ngành dệt may, dệt nhuộm;

- Quản lý và xử lý nước thải;

- Cơ khí (trong đó có xi mạ là một công đoạn của sản phẩm chính);

- Các ngành thuộc công nghiệp chế biến chế tạo;

- Các ngành công nghiệp nhẹ và công nghiệp phụ trợ.

LỢI THẾ CỦA DỰ ÁN

Lợi thế vị trí

Toàn bộ diện tích phát triển của cả Dự án Khu đô thị công nghiệp Dung Quất đều nằm ở huyện Bình Sơn, tỉnh Quảng Ngãi thuộc Khu kinh tế Dung Quất. Trong đó, Khu đất 319 ha phát triển trong Giai đoạn I có ranh giới như sau:

Đây là khu vực có vị trí địa lý và các điều kiện rất thuận lợi để phát triển thành một khu công nghiệp hiện đại, bởi vì:

- Cách sân bay Chu Lai khoảng 5km;

- Cảng biển nước sâu Dung Quất: 3km;

- Đường cao tốc Đà Nẵng Quảng Ngãi 1 km;

- Phía Đông giáp sông Trà Bồng và đường Thanh Niên;

- Phía Bắc giáp Sân bay Chu Lai;

- Phía Nam giáp đường Dốc Sỏi – Dung Quất.

Lợi thế về thuế và các chính sách

- Được áp dụng mức thuế suất thuế thu nhập doanh nghiệp 10% trong 15 năm kể từ năm đầu tiên doanh nghiệp có doanh thu từ dự án, được miễn thuế 04 năm, giảm 50% số thuế phải nộp trong 09 năm tiếp theo kể từ khi có thu nhập chịu thuế. Đối với các dự án quy mô lớn, quan trọng được Thủ Tướng Chính Phủ cho phép áp dụng mức thuế suất ưu đãi 10% trong thời hạn 30 năm.

- Được miễn Thuế nhập khẩu đối với hàng hóa nhập khẩu để tạo tài sản cố định của dự án. Miễn thuế nhập khẩu trong thời hạn 5 (năm) năm kể từ ngày bắt đầu sản xuất đối với nguyên liệu, vật liệu thô, bán thành phẩm trong nước chưa sản xuất được nhập khẩu để phục vụ sản xuất của Dự án.

- Đối với thuế xuất khẩu, theo quy định của Luật thuế Xuất Nhập khẩu. Chính phủ Việt Nam khuyến khích xuất khẩu ngoại trừ xuất khẩu tài nguyên, khoáng sản và một số ít lĩnh vực khác.

- Đối với thuế giá trị gia tăng, đươc áp dụng ác mức thuế khác nhau cho các nhàng nghề khác nhau: 0%, 5%, 10%

- Ngoài ra tỉnh Quảng Ngãi có các chính sách hỗ trợ khác như: đào tạo lao động, xúc tiến thương mại, thực hiện các thủ tục hành chính, …

Lợi thế về cơ sở hạ tầng và các lợi thế từ khu kinh tế Dung Quất

– Hệ thống hạ tầng kĩ thuật điện, thông tin liên lạc sẽ được tỉnh Quảng Ngãi đầu tư và cung cấp đến tận chân hàng rào của dự án.

Về việc cung cấp nước sạch và xử lý nước thải, Hoàng Thịnh Đạt chủ động đầu tư Nhà máy xử lý nước thải với công suất 51,000 CMD và nhà máy cung cấp nước sạch công suất 50,000 CMD, nguồn nước thô được lấy từ kênh thủy lợi Thạch Nham B3 nhằm đáp ứng đủ nhu cầu nước sạch phục vụ hoạt động sản xuất kinh doanh cho các nhà đầu tư.

– Quanh khu vực dự án là trường học, bệnh viện, các đô thị và các tiện ích khác đã và đang được đầu tư bởi Nhà nước và các Nhà đầu tư nhằm phát triển tổng thể khu kinh tế Dung Quất và tỉnh Quảng Ngãi. Do vậy, dự án dễ dàng được tiếp cận và hưởng lợi từ những tiện ích xã hội mà khu kinh tế Dung Quất đang có.

Tiện ích khu đô thị

Lợi thế về nguồn nhân lực

Tỉnh Quảng Ngãi có dân số trên 1,3 triệu người, lực lượng lao động chiếm 53,8% dân số trong độ tuổi lao động. Tính đến thời điểm hiện tại, khu vực này tập trung 8 trường đại học và cao đẳng đang hoạt động. Hằng năm có số học sinh, sinh viên tốt nghiệp từ các trường Trung học phổ thông, chuyên nghiệp, cao đẳng, đại học gần 30.000 học sinh, sinh viên. Ngoài ra, các tỉnh lân cận bao gồm: Quảng Nam, Kom Tum, và Bình Định với dân số khoảng 3,5 triệu người, trong đó lực lượng lao động chiếm từ 50% đến 58,8% dân số trong độ tuổi lao động đảm bảo cung cấp đủ nguồn nhân lực có chất lượng cho các doanh nghiệp.

CÁC PHÍ DỊCH VỤ DỰ KIẾN

| 1. Tiền sử dụng hạ tầng (thanh toán một lần) | 65 USD/ m2 / đến năm 2066 | |

| 2. Tiền thuê đất (thanh toán một lần) | Được miễn theo quy định của chính phủ | |

| 3. Phí Quản lý, duy tu, bảo dưỡng (thanh toán hàng năm) | 0.05 USD/ m2/ tháng | |

| 4. Tiến độ thanh toán sử dụng hạ tầng | Phí đặt trước khi ký thỏa thuận cho thuê đất: 10%

Khi ký Hợp đồng thuê đất: 50% Khi bàn giao đất: 30% Khi bàn giao Giấy chứng nhận quyền sử dụng đất: 10% |

|

| 5. Giá nước sạch | 0.45 USD/ m3 | |

| 6. Phí xử lý nước thải (phụ thuộc vào chất lượng nước thải) | 0.35 – 0.85 USD/ m3 | |

| 7. Phí đấu nối hạ tầng | 6,000 USD | |

| 8. Giá điện | ||

| Giờ cao điểm

Giờ bình thường Giờ thấp điểm |

3,093 VND/KWh = 0.13 USD/KWh

1,669 VND/KWh = 0.08 USD/KWh 1,084 VND/KWh = 0.05 USD/KWh |

|

| * Hóa đơn điện được tính theo tỷ giá quy đổi của EVN tại thời điểm thanh toán và sẽ được trả trực tiếp bằng tiền Việt.

* Các loại phí kể trên chưa bao gồm thuế giá trị gia tăng. |

||

VỊ TRÍ DỰ ÁN

| 5km tới Sân bay Chu Lai |

| 3km tới Cảng Dung Quất |

| 1km đến Cao tốc Đà Nẵng – Quảng Ngãi |